What is Credit Risk, exactly? Credit risk is the risk that a lender takes on when extending credit to a borrower. This is most often caused by the borrower's inability or unwillingness to repay the loan. Credit risk may not only result in loss of principal, interest and cash flow disruptions but also increase collection costs. The risk can be full or partial, and is a primary concern for lenders. The types of credit that lenders can consider when choosing the right lending strategy should be known.

Measurement

Financial institutions are concerned about the measurement of credit risk. Financial institutions must be aware of the client's credit history in order to avoid future losses. Credit risk management systems (CRMIS), which calculate the likelihood that a customer will default on their loan obligations, are used to help determine credit risk. This information is beneficial for financial institutions, solidarity agencies, and other firms involved with credit lending. Here are some tips on how to measure credit risk.

Analyse

An analysis of credit risk uses financial information that assesses the likelihood that a borrower may default on a loan. The company's financial information is combined with external data to determine the likely consequences of default. This is what makes credit management so important. It helps to minimize the risk and forecast it. Credit risk is easily quantifiable, which has a direct effect on the activities and operations of financial institutions. These are the fundamentals of credit risk analysis.

Pricing

Recent growth in structured products, credit derivatives and other credit derivatives has led to a lot of interest for sophisticated models to price credit risks. These models have also been drawn to attention by regulatory concerns as well as empirical data on default rates. This article reviews credit risk modeling and examines its development over the last three decades. It also discusses the statistical characteristics of credit spreads over the time period and the quantitative models that are used to determine creditworthiness. The article concludes on some policy implications for credit-risk pricing.

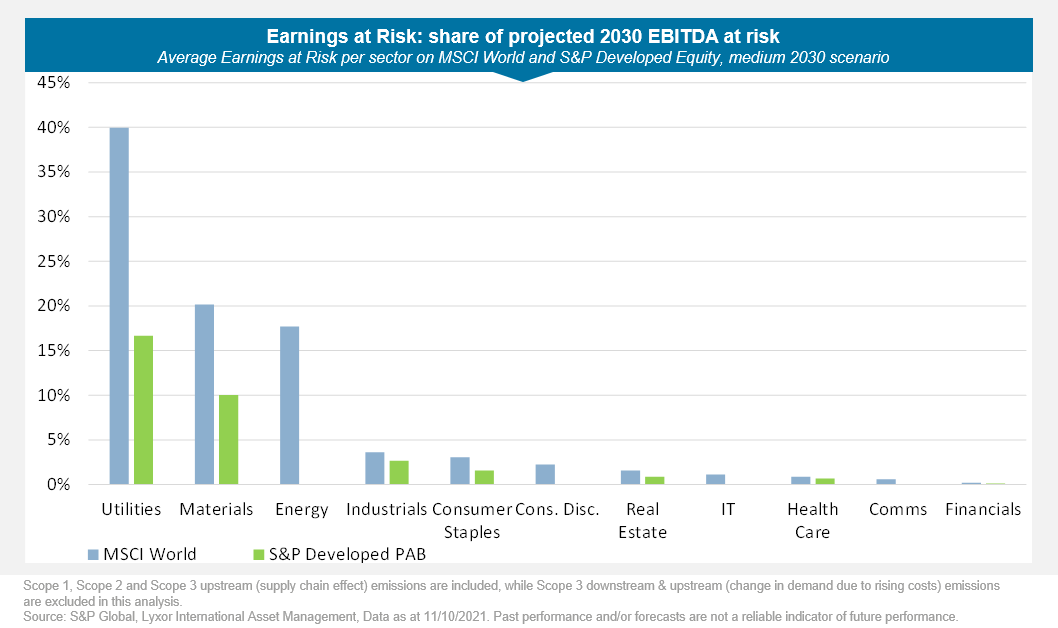

Sector exposure

Financial professionals often mistakenly believe that credit risk and sector exposure are interchangeable. However, although the terms may be different, they are frequently referred to as being the same. Moreover, the two terms are correlated. In fact, a single factor can affect both. Sector exposure, for example, can be a risk factor in a bank's financial health, while credit risk can affect a company's creditworthiness.

Diversification

Diversifying your investments into different assets and asset types can help to manage credit risk. Your portfolio should be diversified to protect against losses in the short-term and maximize your potential upside. Diversifying your assets will reduce specific risks, such as market volatility, which can be caused by wars, political conflict, and interest rate changes. By reducing risk and optimizing your returns, diversifying your assets can help you achieve your long term financial goals.

FAQ

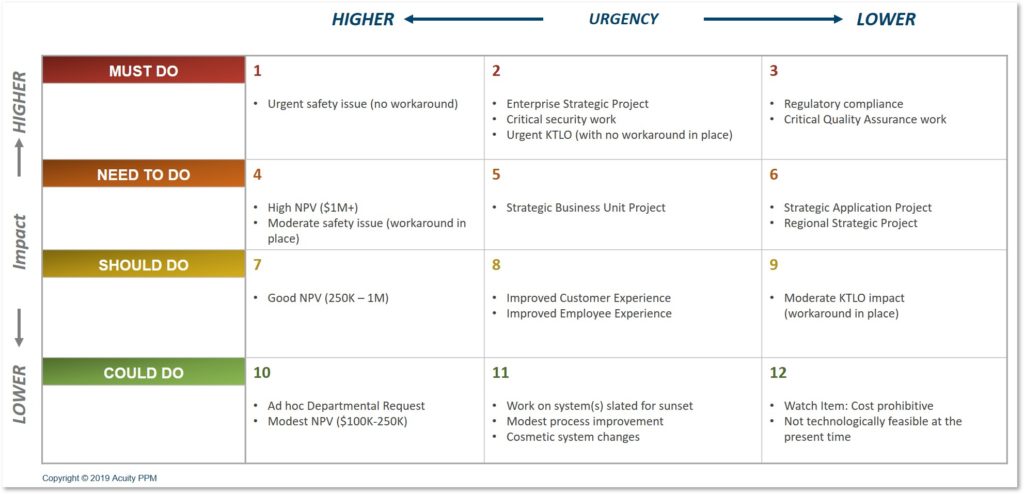

What are management concepts, you ask?

Management concepts are the practices and principles managers use to manage people or resources. They include such topics as human resource policies, job descriptions, performance evaluations, training programs, employee motivation, compensation systems, organizational structure, and many others.

What is the difference in a project and program?

A project is temporary while a programme is permanent.

A project typically has a defined goal and deadline.

It is often done in a team that reports to another.

A program is usually defined by a set or goals.

It is often implemented by one person.

What are the five management process?

Planning, execution, monitoring and review are the five stages of any business.

Planning is about setting goals for your future. Planning includes setting goals for the future.

Execution takes place when you actually implement the plans. Everyone involved must follow them.

Monitoring allows you to monitor your progress towards achieving your goals. Regular reviews of performance against targets, budgets, and other goals should be part.

Every year, there are reviews. They allow for an assessment of whether all went well throughout the year. If not, changes may be made to improve the performance next time around.

After the annual review, evaluation takes place. It helps to determine what worked and what didn’t. It also provides feedback on the performance of people.

What are the main four functions of management

Management is responsible to plan, organize, direct, and control people and resources. This includes setting goals, developing policies and procedures, and creating procedures.

Management assists an organization in achieving its goals by providing direction, coordination and control, leadership, motivation, supervision and training, as well as evaluation.

The four main functions of management are:

Planning - Planning involves determining what needs to be done.

Organizing – Organizing means deciding how to organize things.

Direction - This is the art of getting people to follow your instructions.

Controlling - Controlling means ensuring that people carry out tasks according to plan.

What are the 3 main management styles?

These are the three most common management styles: participative (authoritarian), laissez-faire (leavez-faire), and authoritarian. Each style is unique and has its strengths as well as weaknesses. Which style do you prefer? Why?

Authoritarian - The leader sets the direction and expects everyone to comply with it. This style works best if the organization is large and stable.

Laissez-faire – The leader gives each individual the freedom to make decisions for themselves. This style is best when the organization has a small but dynamic group.

Participative - The leader listens to ideas and suggestions from everyone. This style is most effective in smaller organizations, where everyone feels valued.

Statistics

- 100% of the courses are offered online, and no campus visits are required — a big time-saver for you. (online.uc.edu)

- The BLS says that financial services jobs like banking are expected to grow 4% by 2030, about as fast as the national average. (wgu.edu)

- Hire the top business lawyers and save up to 60% on legal fees (upcounsel.com)

- Our program is 100% engineered for your success. (online.uc.edu)

- The average salary for financial advisors in 2021 is around $60,000 per year, with the top 10% of the profession making more than $111,000 per year. (wgu.edu)

External Links

How To

How do I get my Six Sigma license?

Six Sigma is a tool for quality management to improve processes and increase efficiency. It's a system that allows companies to get consistent results from operations. Named after the Greek word for "sigmas", the name refers to the first two letters. Motorola developed this process in 1986. Motorola realized that standardizing manufacturing processes was necessary to make products more efficient and less expensive. Due to the different workers involved, there was a lack of consistency. To resolve this issue, they used statistical tools like Pareto analysis and control charts. These techniques would be applied to every aspect of the operation. So, after applying this technique, they would be able to make changes where there was room for improvement. When you are trying to obtain your Six Sigma certification, there are three steps. Finding out if the certification is available for you is the first step. Before you take any exams, you'll need to take some classes. After passing the classes, you will be able to take the tests. The class material will be reviewed. Once you have completed the class, you will be ready for the test. You will be certified if you pass the test. And finally, you'll be able to add your certifications to your resume.